Reed Hastings, the CEO of Netflix, has just published a book No Rules Rules : Netflix and the Culture of Reinvention. If this book is anything like his slidedeck on Culture and HR practices then it will certainly be a great read.

Unbeknownst to many, Netflix has not always been what it is today. It started life as a mail order DVD service. Which serves as a nice introduction and segue to the topic of corporate transformations.

Look through a company’s Investor Relations material and you will quickly see that most believe they can and will transform themselves into something different to what they have been for most of their existence. There normally will be all sorts of inspirational and energetic language to galvanise their employees towards the new world and frown upon the naysayers who say it can not be done. Quite often, the aspirational end states come in cycles. In the late 1990s it was all about the Dot.com economy and today it is all about fintech, electric vehicles and ESG. But the reality is transforming an existing company is extremely hard and extremely rare. The vast majority, more than 95%, will fail to transform themselves into something bigger or better notwithstanding all of their good intentions and marketing material saying otherwise. Why is that?

For starters, let’s see what lessons can be learnt from the past. In the late 1990s, Amazon was just a book selling platform and already a clear threat in plain sight for Barnes & Noble and Borders in the US and eventually Waterstones in the UK. Did Barnes & Noble, Borders or Waterstones transform themselves because of this threat? Or did they believe they had an unassailable business model which provided them a false sense of business security? What about the camera industry? With cameras ubiquitous on every smartphone, the need for a dedicated camera and film were greatly reduced. What did Kodak, Fuji Film, Canon, Nikon do? Were they able to transform themselves? Fast forward a few years and eventually Amazon moved beyond books into other areas of retail. Did Walmart, Target or Best Buy fundamentally or radically change their business models to prevent themselves suffering the same fate as the book sellers? After all, these retailers had the good fortune of seeing how the early innings went between Amazon and the book sellers. What about Blockbuster? Remember the place that you used to go to rent a DVD? Did they see the threat of online video on demand and transform? Sadly, in all of these instances the answer was no. They didn’t fundamentally transform their business into a better or bigger business. That’s not to say that it never happens. Some companies have succeeded. IBM did it. Apple did it. And more recently, Netflix did it too.

As mentioned earlier, Netflix has not always been what it is today. It started life as a mail order DVD service with all the attendant challenges and costs of mailing and receiving physical DVDs. Back in 2011, Reed Hastings, Netflix CEO, realized the future of mail order DVD was futile and made a startling decision to partition the company into a mail order DVD entity, Qwikster, and the streaming Netflix that we know of today. Mind you, this was nearly a decade after being in business, having positive net income and meaningful net income growth. At the time, he stated,

“For the past five years, my greatest fear at Netflix has been that we wouldn’t make the leap from success in DVDs to success in streaming. Most companies that are great at something – like AOL dial-up or Borders bookstores – do not become great at new things people want (streaming for us) because they are afraid to hurt their initial business. Eventually these companies realize their error of not focusing enough on the new thing and then the company fights desperately and hopelessly to recover. Companies rarely die from moving too fast, and frequently die from moving too slowly.”

– Reed Hastings, NETFLIX CEO

How many firms would be convinced that the old (DVD) is dead and that the new (streaming) will displace the old and be willing to cannibalize their core business? There may not be confirmation for the success of their strategy for years during which time they will surely face the ire of investors?

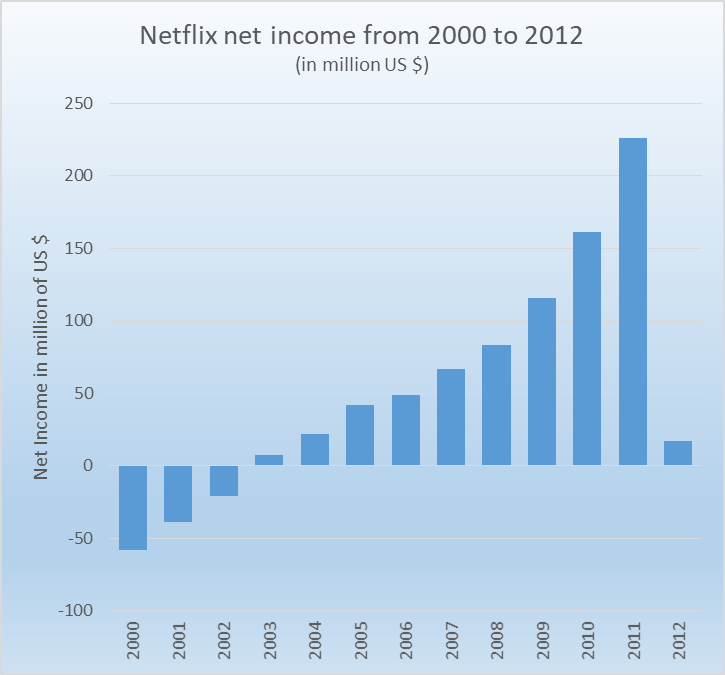

In Netflix’s case, they went from $200+ million of net income in 2011 to less than $20 million in 2012.

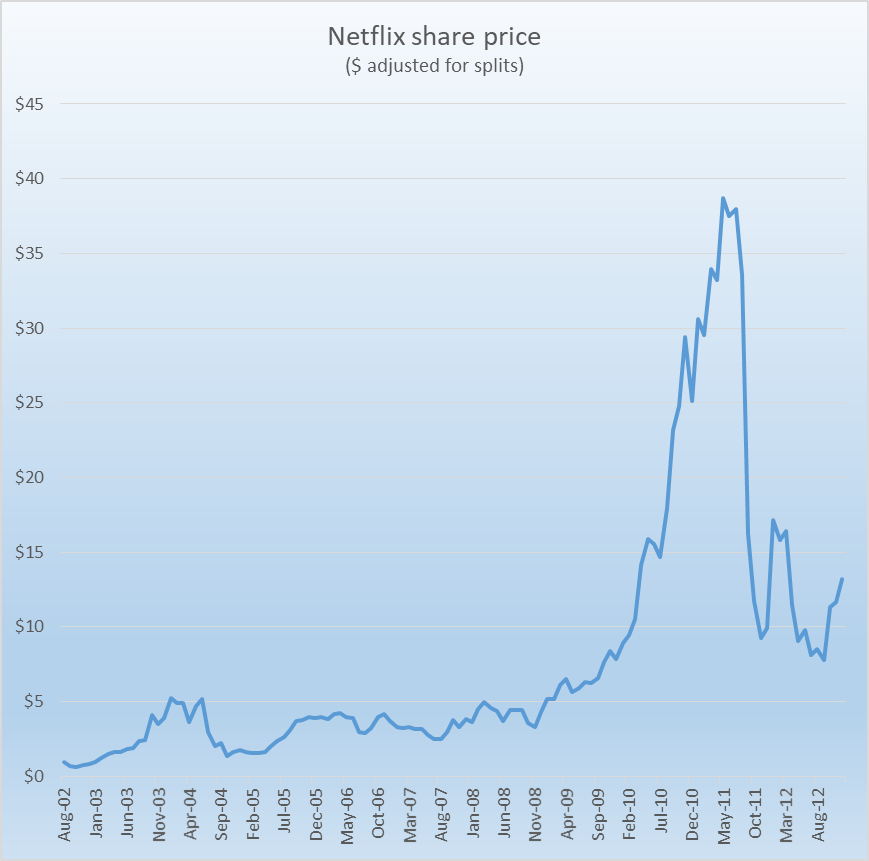

And their stock price decreased nearly 80% after the turn in strategy in 2011.

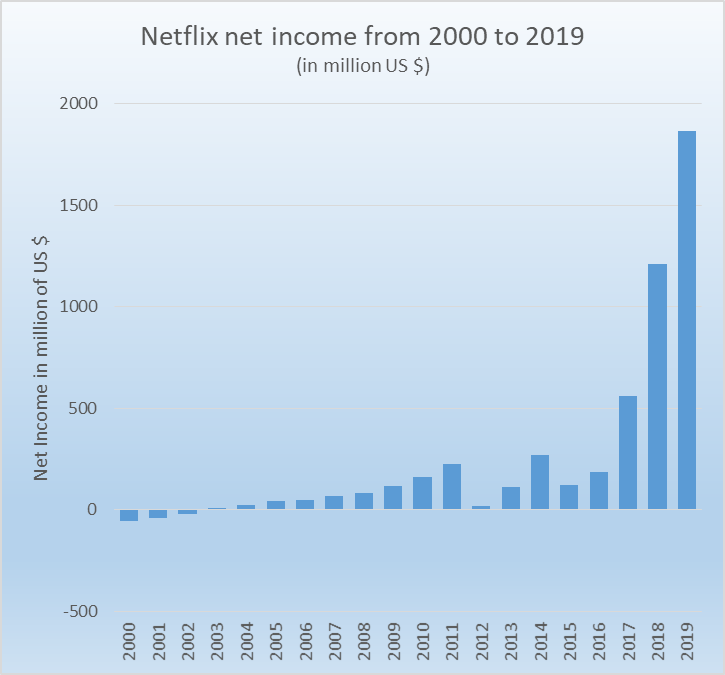

It wasn’t until 2017, a full 6 years later, that Netflix compellingly exceeded their 2011 net income of $200+ million with an eventual growth to nearly $2 billion of net income in 2019, 9 years after the fateful decision to ditch the physical DVDs.

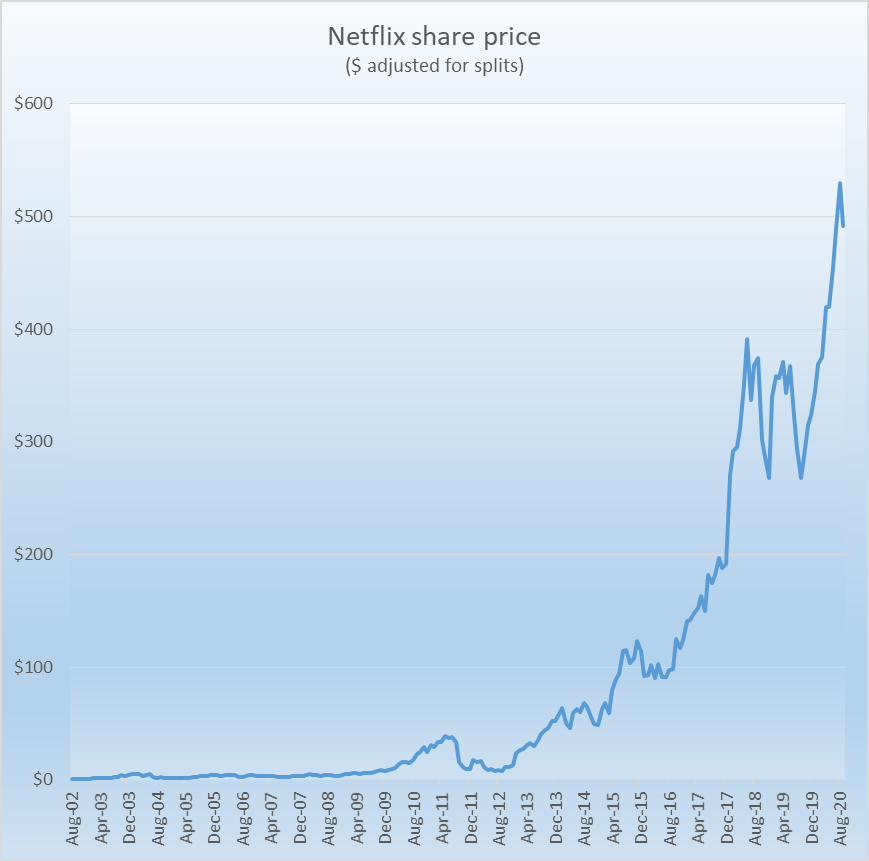

After an initial share price drop, Reed Hastings was ultimately vindicated for his pivot in strategy and transformation from 2013 onwards. And boy was he ever vindicated.

For those familiar with Reed Hastings, this may not come as a surprise. As his slidedeck on business and culture highlighted his independent and orthogonal thinking, which ultimately is the foundation of any successful turnaround or transformation.

The real question is how many other CEOs are willing to temporarily go backwards financially, face shareholder opprobrium for several years and possibly be replaced before their transformative strategy is ultimately vindicated? Put that way, it’s no surprise that there are so few turnarounds or transformations.

“The day before my inauguration President Eisenhower told me, You’ll find that no easy problems ever come to the President of the United States. If they are easy to solve, somebody else has solved them. I found that hard to believe, but now I know it is true.

John F Kennedy, 35th US President