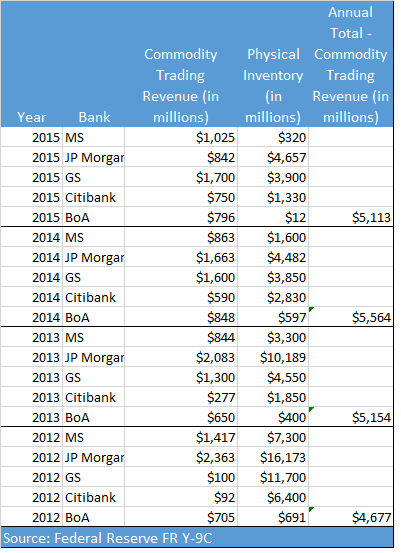

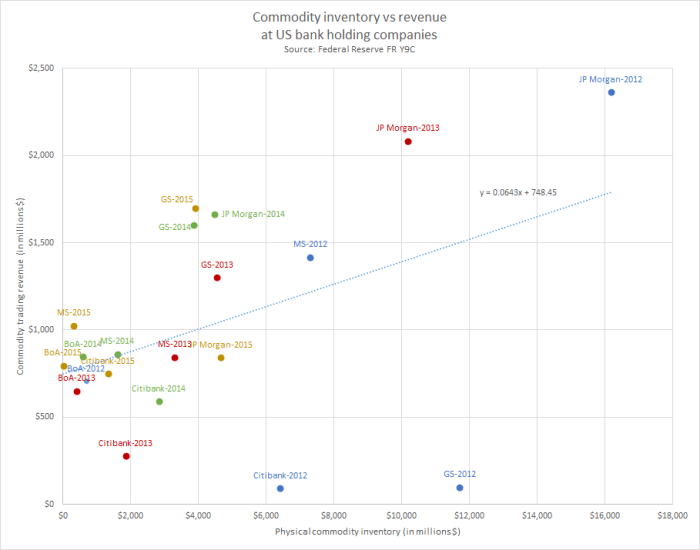

Here’s a table and graph of the past several years of commodity revenues at various US bank holding companies. Here are my takeaways….

- The overall market size has not dramatically changed over the years notwithstanding the media attention on waning commodity revenues at banks;

- The balance sheet utilization for physical inventory has shrunk considerably;

- JP Morgan’s commodity revenues have been on a steady downtrend; Citi on a steady uptrend; GS consistent other than a shocker in 2012 and BoA is a flat out surprise (did they include their lending portfolio?);

- It would be interesting to benchmark these figures against headcount and VaR.