I stumbled upon a few interesting European cheese/dairy companies which piqued my interest in the industry and their businesses. The companies are Lactalis Group (“Lactalis”), Fromageries Bel (“Bel”) and Parmalat. They are three separate companies with some overlap in shareholder ownership.

Fromageries Bel

Fromageries Bel is France’s third largest pure cheese producer after Lactalis (formerly Besnier) and Bongrain. Together these three companies produce more than half of the total cheese sales in France, a country with the highest per capita consumption in the world. You may not be familiar with Bel as a company but you are most likely familiar with their five core products – Mini Babybel®, Boursin®, Kiri®, Leerdammer®, & the Laughing Cow®.

Family business & history

The company was founded in 1865 by Jules Bel in France’s Jura region near the Swiss border. Jules Bel was joined and then succeeded by his son Léon Bel. The younger Bel was responsible for developing and registering a trademark for the Laughing Cow® cheese in 1921. In the 1930s, Léon Bel was joined by his son in law Robert Fiévet and appointed CEO in 1937. If Léon Bel had succeeded in establishing the Laughing Cow ® as successful product, Fiévet would build the company into one of the top three cheese producers in France. Then, in the 1950s their attention moved toward expansion. They reorganized, moved their headquarters to Paris and listed on the Paris Stock Exchange. By the late 1970s, a new generation entered the family-owned business, with the appointment of Bertrand Dufort, Fiévet’s son-in-law. In 1981 the company simplified its current name, to Fromageries Bel.

Interestingly enough, Bel was not alone as a market leader in the French cheese market. Another group, Besnier (today known as Lactalis), was aggressively expanding and consolidating the French dairy industry. Besnier was a private company wholly owned by the Besnier family and led by Michael Besnier. Whereas Besnier and Bongrain had developed a strong presence in the molded cheese segment, Bel had a stronghold on the melted cheese market. In 1993, Besnier began purchasing shares in Bel. By the end of 1994, Besnier (Lactalis) owned 20 percent of Bel. Bel was an easy target but the acquisition never happened. A separate family holding company, known today as Unibel, was set up in the 1920s and was Bel’s majority shareholder.

As of today, the shareholdings in Fromagerie Bel are as follows – Unibel & family 71% , Lactalis ( formerly Besnier) 24%, Treasury shares 1.5%, Other shareholders (free float) 3.5%. Yep, that’s right. Only 3.5% of the float is available and not locked up. We’ll come back to this point later.

Lactalis

Groupe Lactalis, formerly known as Besnier, is France’s largest dairy products producer and one of the largest cheese manufacturers in the world. It ranks second in the global dairy market, after Nestle. Whereas you may never heard of the company, you will most likely be familiar with the company’s renowned President label and other brands such as Sorrento, Rondele, etc. Lactalis is a private company 100% owned by the Besnier family.

Family business & history

Besnier S.A., today known as Lactalis, was founded in 1933 by Andre Besnier in Laval, in the Loire Valley region of France. Besnier remained a small, single factory operation well into the 1960s. Andre’s son, Michel Besnier, took over operations in the late 1950s with a goal to expand its operations to multiple plants and diversify the company’s dairy products. As a first step, Besnier created its own brand, the famous President Camembert label, in 1968. From the next year onwards, Michel Besnier pursued a series of acquisitions through the 1970s, 1980s, 1990s, and 2000s which catapulted the private company into the 2nd largest dairy company in the world.

http://www.lactalis.fr/english/groupe/historique.htm

Parmalat

Parmalat was founded by Calisto Tanzi in 1963 in Italy. From the start, the business pursued the expansion of new milk products which led to their flagship product – milk pasteurized at ultra-high temperatures. This was revolutionary at the time because it maintained an unrefrigerated shelf life that exceeded six months before opening. Parmalat expanded from such humble beginnings to become a large multinational firm in the late 1990s, becoming the largest Italian food company and fourth largest in Europe at the time.

Unfortunately, an accounting scandal of epic proportions was discovered in 2003 leading to Parmalat’s bankruptcy. A new Parmalat was listed on the Italian stock exchange in October 2005.

In 2011, Lactalis bought an additional 54% of Parmalat. This took Lactalis stake in the publicly listed company to 83.3% after accounting for the 29% of the company already owned before the additional acquisition. This means only 16.7% of the common equity is freely available. We’ll come back to this point later.

Investment thesis

I purchased shares in Fromageries Bel for the following reasons.

Financials

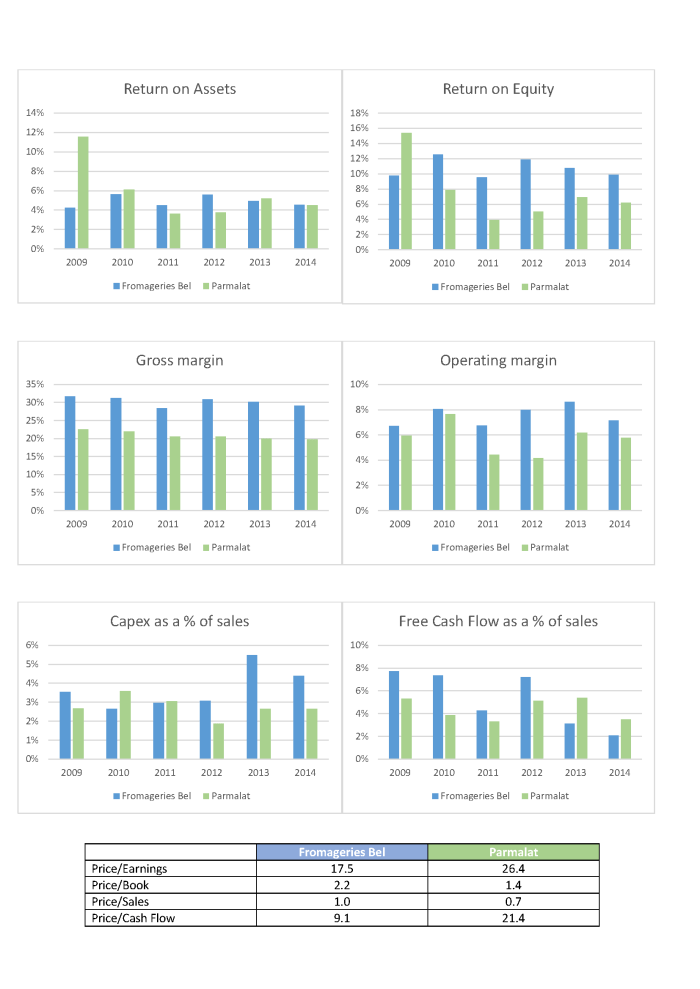

- Their financials are decent. Here’s a decent CFA Society writeup on the company.

- Solid cash flow generation allows the company to finance capital expenditures with internal financing.

- Demonstrated long term track record of performance – delivering quality products & strong financials.

Favorable backdrop

- Lactalis under the Besnier family appear to be an Outsider like firm which excels at acquisition and consolidation in the dairy industry.

- Of the companies owned by Lactalis, I believe only Fromageries Bel and Parmalat are publicly listed equities but not wholly owned.

- There is the potential for the shares not in the controlling shareholder’s hands, Lactalis’ hands, to eventually be bought out or tendered for to gain 100% ownership.

Why Fromageries Bel and not Parmalat?

I believe the incentives are better aligned in Fromageries Bel. I am working under the assumption that since Lactalis, a direct competitor, has a 24% stake in Fromageries Bel it would be hard for the Bel family or Fromageries Bel’s management to get away with any shenanigans. This counterbalance does not seem to exist amongst the shareholdings of Parmalat.